This article compares with SME realities in mind: fast onboarding, low admin load, predictable costs, and “just enough” features.

What is Salesforce?

Salesforce is a cloud-based customer relationship management (CRM) platform that unifies sales, service, marketing, and commerce in one ecosystem. It’s known for deep customization (from point-and-click builders to code), a massive marketplace of add-ons, and robust analytics and automation, making it popular with organizations that need complex, cross-department processes and enterprise-grade governance.

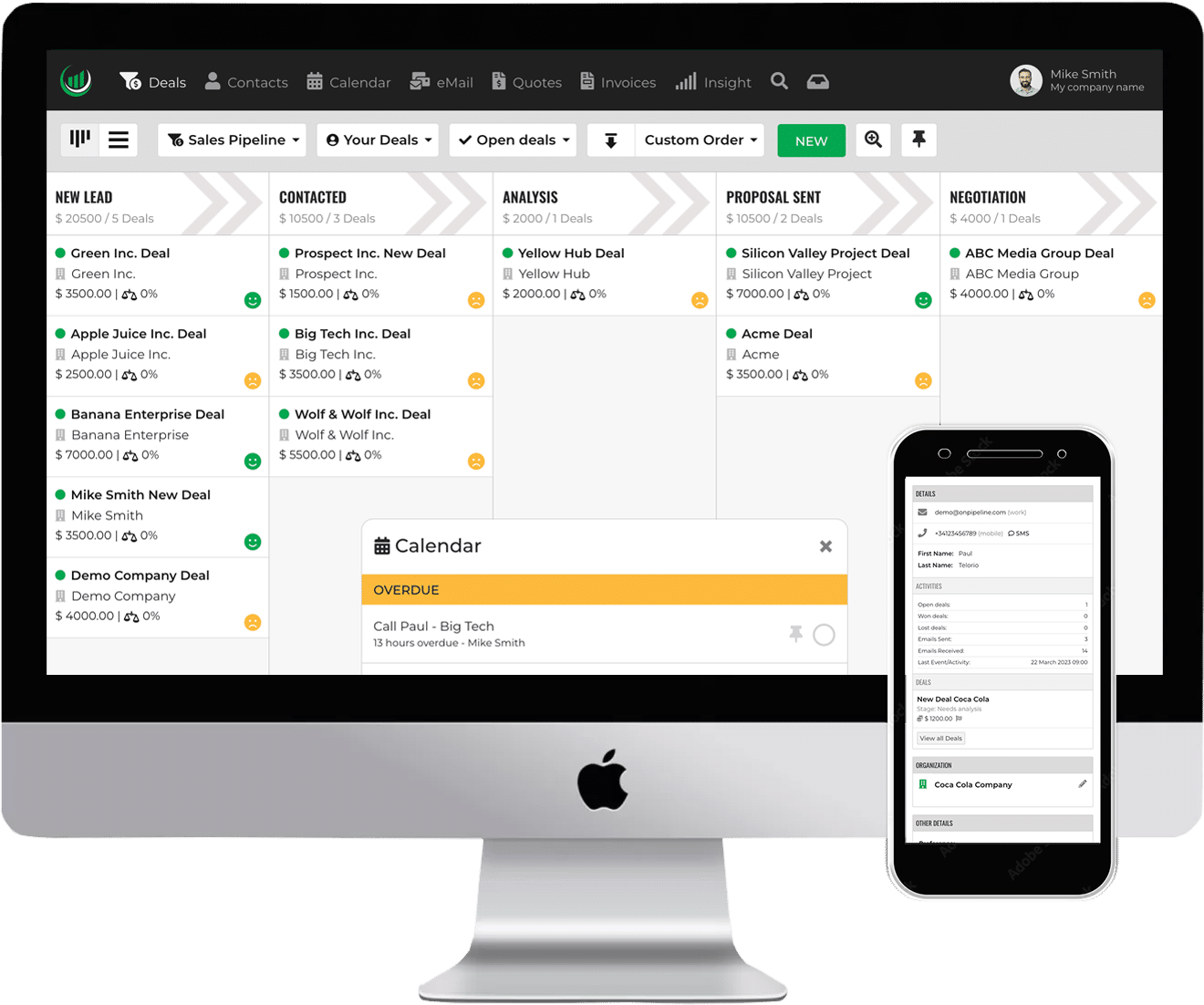

What is Onpipeline?

Onpipeline is a sales-centric CRM designed for small and mid-sized businesses that want speed and simplicity. It focuses on core sales workflows, pipeline tracking, quoting, e-signature, and invoicing, plus light automation, email/calendar sync, and straightforward reporting, all with predictable pricing and minimal admin overhead.

The decision in one paragraph

Onpipeline excels when you want sales teams productive in days, not months, with quoting, e-sign, and invoicing built into the same tool. It minimizes platform overhead and admin burden without giving up the features most SMEs actually use.

Salesforce is the better fit if you’re orchestrating multiple departments (Sales + Service + Marketing + Commerce), enforcing complex governance, or planning custom apps on the CRM itself.

Evaluation criteria (SME-centric)

- Time-to-value: How quickly can reps and managers be productive?

- Feature fit: Do we get the “must-haves” without marketplace hunting?

- Simplicity & admin load: Can we run it without a dedicated admin?

- Integrations: Can we connect email, calendar, accounting, and a few essential tools?

- Reporting: Do managers get clear pipeline, activity, and forecast views out of the box?

- Scalability & risk: What happens as we grow or need something custom?

- Total cost of ownership (TCO): Licenses + add-ons + implementation + ongoing admin.

How they differ

1) Setup & onboarding

Onpipeline: Opinionated and streamlined. Configure pipelines, stages, basic permissions, sales inventry; import data; connect email/calendar. Most SMEs self-onboard.

Salesforce: Mamy choices and options, object model, sharing rules, flows, profiles/permission sets, sandboxes, release process. Great for complex needs; typically longer to stand up.

SME takeaway: If “we need this running next week” is real, Onpipeline wins.

2) Data model & everyday workflow

Onpipeline: Sales-first objects (leads/contacts/deals) flowing natively to quotes → e-sign → invoices. Minimal object sprawl; fewer decisions; less training.

Salesforce: Modular data model across multiple clouds. Supports complex processes (entitlements, SLAs, CPQ variants, multi-brand orgs) but adds cognitive load.

SME takeaway: Onpipeline covers 95% of standard SME sales workflows.

3) Built-in features (no marketplace required)

Onpipeline: Quoting, e-signature, basic stock/pricing, activity tracking, task reminders, web forms, email templates — all native.

Salesforce: “Pick your stack” from clouds and AppExchange. Extremely capable, but you’ll compare, buy, and maintain more components.

SME takeaway: Fewer moving parts = fewer potential points of failure and surprises on cost.

4) Automation

Onpipeline: Lightweight if/then rules—assign leads, set reminders, move stages, send follow-ups.

Salesforce: Enterprise-grade automation (Flow, approvals), integration fabric, and dev options (Apex, LWC).

SME takeaway: If your automation needs are simple, Onpipeline avoids the “flow-builder maze.”

5) Integrations

Onpipeline: API, webhooks, and connectors for common SME tools; Zapier/Make cover long tail.

Salesforce: Vast ecosystem, middleware options, and partner network.

SME takeaway: Onpipeline is enough for email/calendar + accounting + essentials.

6) Reporting & analytics

Onpipeline: Prebuilt dashboards for pipeline health, win rates, velocity, and rep activity; easy exports.

Salesforce: Robust reports and dashboards across objects; extensible to enterprise BI.

SME takeaway: Managers get useful views faster in Onpipeline.

7) Security, governance, and compliance

Onpipeline: Roles/permissions, audit trails around docs/signatures; suitable for SMEs with standard requirements.

Salesforce: Mature governance (RBAC depth, sandboxes, release management), often required by larger environments.

SME takeaway: Choose based on your compliance bar and change-management needs.

8) Customization & extensibility

Onpipeline: Custom fields, multiple pipelines, templates, and API.

Salesforce: Extensible platform; build custom apps and processes.

SME takeaway: Onpipeline fits teams that value guardrails.

9) Pricing & TCO (conceptual)

Onpipeline: Few add-ons, predictable per-user pricing, low admin FTE.

Salesforce: Multiple editions and add-ons; may include partner costs and dedicated admin time.

SME takeaway: Onpipeline’s simplicity keeps TCO tame.

Side-by-side comparison table

| Dimension | Onpipeline | Salesforce |

| Primary fit | SMEs needing fast, clean sales execution | Orgs orchestrating multiple clouds and teams |

| Time-to-value | Days (self-onboardable) | Months (design + rollout) |

| Sales flow depth | Lead, Deal, Quote, e-Sign, Invoice built-in | Often needs CPQ/contract/e-sign add-ons |

| Automation | Simple if/then rules | Enterprise flows |

| Integrations | API + Zapier/Make + common connectors | AppExchange + middleware + partners |

| Reporting | Prebuilt dashboards | Customizable |

| Customization | Custom fields, multiple pipelines, templates | Full platform (Apex/LWC), custom apps |

| Admin overhead | Low; <0.25 FTE typical | Medium–high; admin(s) plus release mgmt |

| Governance | Basic roles/permissions & audit trails | Deep RBAC, sandboxes, change control |

| Scalability | Great up to ~200 users (guideline) | Scales to very large, multi-department orgs |

| TCO profile | Predictable, fewer add-ons | Variable; add-ons and partner time accumulate |

Annual Costs

Onpipeline: Sales CRM with quotes + e-signature + invoicing included in plan pricing—no extra modules.

Salesforce (to match features): Sales Cloud + Revenue Cloud (CPQ) for quoting/subscriptions + an e-signature app from AppExchange.

20 Users, Same Features

| Stack | What’s in the price | Per user / month | Per month | Per year (20 users) |

|---|---|---|---|---|

| Onpipeline (Pipeline) | Plan with quotes + e-sign + invoicing included | $25 | $500 | $6,000 |

| Onpipeline (Advanced) | Advanced plan (inventory, more automation, etc.) | $58 | $1,160 | $13,920 |

| Salesforce (Growth) | Sales Cloud (Enterprise*) + Revenue Cloud Growth ($150) + e-sign ($30) | $165* + $150 + $30 = $345 | $6,900 | $82,800 |

| Salesforce (Advanced) | Sales Cloud (Enterprise*) + Revenue Cloud Advanced ($200) + e-sign ($50) | $165* + $200 + $50 = $415 | $8,300 | $99,600 |

* Public reference often cites $165/user/mo for Enterprise; official pages may vary by edition/region.

With the same functional scope, Onpipeline runs about $6k–$13.9k per year for 20 users because quotes, e-signature, and invoicing are included in the plan.

Salesforce, to reach the same features, typically requires Sales Cloud + Revenue Cloud + an e-sign app: about $82.8k–$99.6k per year in licenses alone—before implementation/partner costs.

Bottom line

Onpipeline delivers exactly what most SMEs need: a sales-first CRM with quoting, e-sign, and invoicing that teams can run without a dedicated admin. You get speed, clarity, and predictable costs – without giving up the core features that move revenue.