In sales today, growth doesn’t come from one superstar closer. It comes from an ecosystem: your sales process, your qualification method, your CRM hygiene, your pipeline discipline, your post-sale retention motion, and now — your automation stack.

This article is a playbook you can actually apply. It’s structured in 4 pillars:

- Sales Strategy & Methodologies

- Pipeline, Forecast & Performance

- CRM & Operations

- Customer Relationship & Retention

Let’s go pillar by pillar.

Sales Strategy & Methodologies

Create urgency without sounding desperate

Most reps try to force urgency in sales from the outside: “Promo ends Friday,” “We only have 2 slots left,” “My VP needs an answer”. That’s pressure, not urgency. Pressure creates resistance. Urgency creates momentum.

Real urgency is internal to the buyer.

Here’s how you create it without being aggressive:

Quantify the cost of waiting – Example: “If the onboarding delay pushes you out one more quarter, what’s the revenue impact for you?” You’re not pushing. You’re making the hidden pain visible.

Anchor to buyer deadlines, not yours – “You told me your board review is November 12. If this isn’t live by then, what happens in that meeting?” Now timing is *their* problem, not your quota problem.

Define opportunity loss, not fear – Fear-based selling (“you’ll get fired if…”) is amateur. Executive buyers respond better to upside math: “Teams that automate this step typically recover 8–12 hours per rep per week. If that’s true for you, that’s ~480 hours/year. Worth moving now?”

Urgency sounds respectful when it’s about the buyer’s business math, not your discount calendar.

Consultative selling: how to sell without sounding “salesy”

Consultative selling is often misunderstood as “be nice and listen a lot”. Wrong. It’s actually controlled discovery with expert positioning.

Great consultative sellers do three things:

Diagnose like a specialist – “Walk me through your pipeline review. How accurate is your forecast one week before the end of month?” That’s not small talk. That’s clinical.

Reframe the problem – You’re not selling the tool. You’re selling a better definition of the problem. Example reframe: “Your issue isn’t lead volume. It’s conversion from demo to proposal. Doubling leads will just double waste.”

Co-build the solution – Instead of “Here’s what we do,” it’s “Here’s how teams like yours usually solve this. Would that work in your org or does something break politically/operationally?”

Psychology note: people hate being sold to, but they love being advised as peers. When you sound like an internal consultant who happens to have software that solves the issue, buyers relax. They trust. And trusted vendors win even when they’re not the cheapest.

SPIN, SNAP, MEDDIC, BANT — which one and when?

Sales leaders love frameworks. Reps love knowing “what do I actually ask?” Here’s the matching logic:

BANT (Budget, Authority, Need, Timeline)**

Use BANT for high-velocity, transactional deals. Great for SDR qualifying inbound leads fast. Weak in enterprise because budget and authority are often fluid early.

SPIN (Situation, Problem, Implication, Need-payoff)

Use it in discovery calls when the buyer thinks “we’re fine”. SPIN shines at surfacing hidden pain by exploring implications: “If this manual reporting is wrong, who gets blamed?” It turns small annoyances into critical problems.

MEDDIC (Metrics, Economic buyer, Decision criteria, Decision process, Identify pain, Champion)

Use it for complex B2B, multi-stakeholder, 5- to 6-figure+ ACV deals. MEDDIC is less about ‘does this lead qualify’ and more about ‘can this deal get signed internally’. It’s an internal deal map.

SNAP (Simple, iNvaluable, Aligned, Priority)

Use it when you’re selling to time-poor execs. SNAP is about minimizing friction and aligning to top-level initiatives — “This maps directly to your CFO’s mandate to cut CAC by 15%”

Practical takeaway:

- SMB / inbound / short cycle → BANT + SPIN-style implication questions

- Mid-market / consultative cycle → SPIN + light MEDDIC

- Enterprise / political / legal involved → Full MEDDIC

- Selling to C-level with no time → SNAP framing

If you force the wrong framework, you either underqualify (hello churn) or overcomplicate (hello stalled mid-market deal).

12 sales strategies that actually work

There are a million “tactics.” Most are noise. These are the ones that consistently convert:

- Map business pain to personal pain (VP Sales cares about forecast accuracy, not “more leads”).

- Sell the after-state, not the feature list.

- Use customer stories that match size/industry, not generic case studies.

- Get next steps on *every* call (if you don’t have a calendar date, you don’t have a deal).

- Send mutual action plans – a shared checklist with owners and dates.

- Multithread ASAP. Single-threaded = fragile.

- Put pricing on the table earlier than you’re comfortable with.

- Recap meetings in writing with agreed value and impact (this becomes ammo in their internal buy-in).

- Disqualify politely but fast. Time is finite.

- Ask “What could kill this internally?” and shut up.

- Don’t sell ‘tool’; sell ‘risk reduction’.

- Make the CFO your ally: speak in cost avoidance, margin impact, payback period, not “cool features.”

Pipeline, Forecast & Performance

Sales pipeline: common mistakes (and how to avoid them)

The fastest way to miss revenue is lying to yourself about pipeline quality.

The usual sins:

Stage inflation – Reps move deals forward emotionally (“They loved the demo!”) instead of behaviorally (“They involved Procurement”). Fix: stage definitions must be tied to buyer actions, not seller feelings.

Whales-only pipelines – A pipeline full of 2 giant logos feels exciting and is actually lethal. You need depth, not just size.

No exit criteria – Deals sit “in proposal” for 63 days and no one kills them. Stuck deals are silent pipeline rot. Build a rule: if there’s been zero movement in X days, it auto-flags for inspection or purge.

Healthy pipeline = right volume, right mix, right velocity.

Sales forecasting: realistic, not optimistic

Optimistic forecasts kill credibility with finance and destroy trust with leadership. And once finance stops believing you, it gets political fast.

To forecast like an adult:

Use historical conversion rates by stage – Example: if “Evaluation → Procurement Signed” historically converts at 42%, don’t call it 90% just because “they’re super into us.”

Weight by deal proof, not deal vibe – Has the economic buyer verbally confirmed budget exists? Has Legal reviewed the MSA? Is there a launch date tied to a business event? Those are proof points.

Scenario plan – You need at least 3 views: commit (what you’d bet reputation on), best case (if everything lands), downside (what happens if 1 big deal slips).

A forecast isn’t a wish list. It’s an operating plan. Finance builds hiring, marketing spend, cash burn, everything around that number.

Funnel blockers: how to find and unblock them

If your funnel is leaking, you fix the choke point, not the top.

Here’s the diagnostic loop:

- Look at conversion % by stage. Where’s the biggest cliff?

- Look at time-in-stage. Where are deals stalling the longest?

- Listen to call snippets from that exact stage. Is the objection product, price, internal politics, urgency, or authority?

Then unblock with the right tool:

- Price objection → arm reps with ROI calculators and alternative packaging.

- We need to think → give them a Mutual Action Plan so “thinking” becomes “who does what by when.”

- No champion → coach your rep to build one or exit the deal and reinvest time elsewhere.

Pipeline template: Excel vs CRM (who actually wins?)

Teams love spreadsheets because they feel fast. And, yes, Excel/Sheets is fine when:

- Sales team = founder + 1 rep

- Deal count is <10 active

- Sales cycle is <7 days

But spreadsheets break hard when:

- You need auditability (“Who moved this deal and why?”)

- You need forecast roll-up across reps/regions

- You need automation (tasks, reminders, playbooks, renewal alerts)

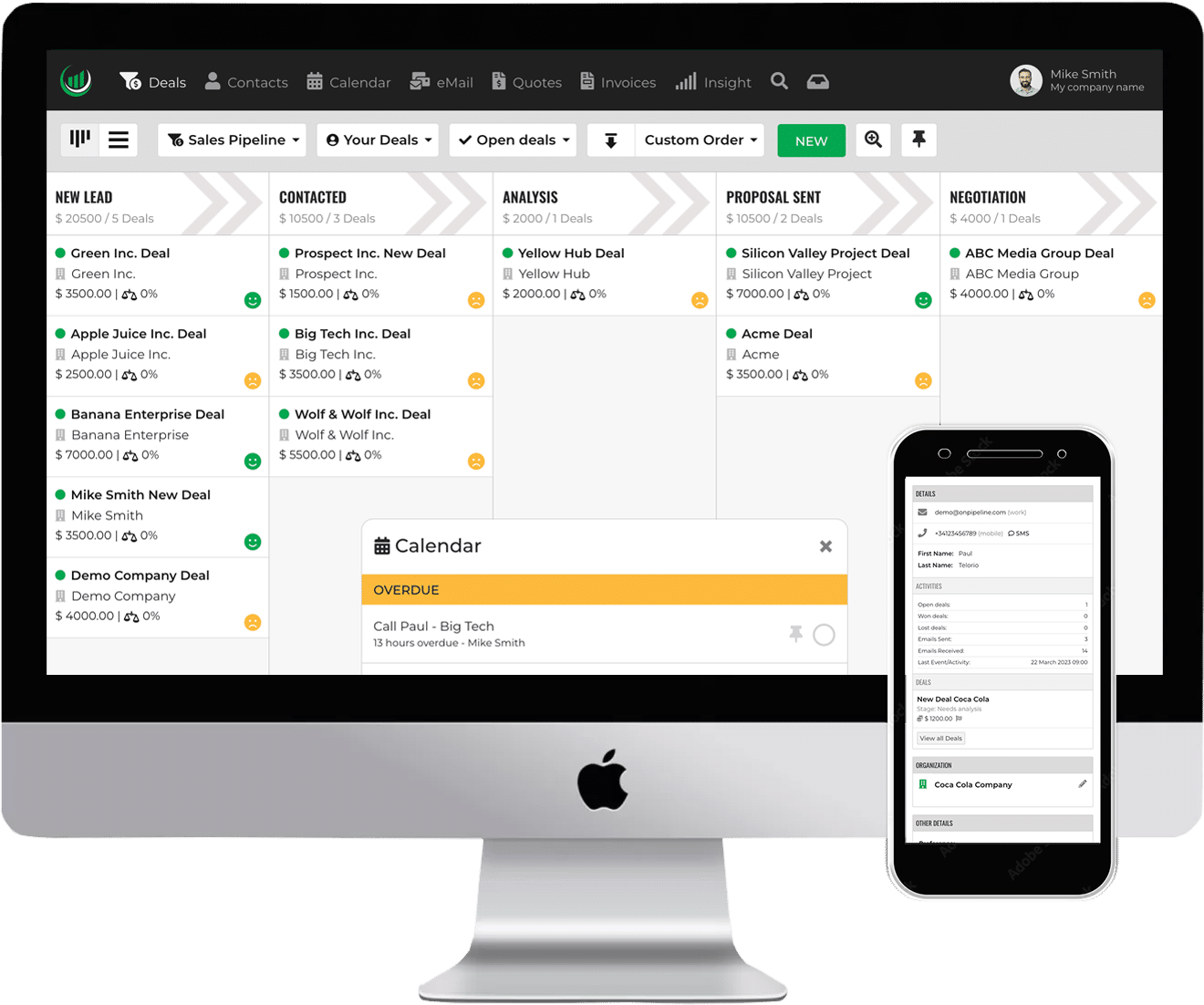

CRMs aren’t just databases. They are workflow engines. They keep humans from dropping revenue. The second you’re managing repeatable sales — not one-off hero deals — CRM wins, every time.

CRM & Operations

Onpipeline vs Salesforce: what you actually need

There are hundreds of CRMs, but let’s talk two extremes to illustrate the decision:

The wrong CRM for your stage doesn’t just waste money — it kills adoption. And an unused CRM is basically a blindfold on the whole company.

Is a CRM worth the money? Calculating ROI

Here’s how to think about CRM ROI so finance says yes:

1. Time saved per rep per week

Example: If CRM automations save each rep 3 hours/week, and a rep’s loaded cost is $80/hour, that’s $240/week → $12.5K/year/rep.

2. Deals not lost due to follow-up gaps.

Even 1 recovered deal can justify a year of license cost.

3. Forecast accuracy.

Finance will pay for predictability. When you can plan hiring and cash with confidence, you reduce risk. Reduced risk has dollar value.

4. Faster onboarding of new reps

If ramp time drops from 5 months to 3 because playbooks live in CRM, that delta is massive revenue acceleration.

When you pitch CRM internally, don’t say “we’ll be more organized.” Say “we’ll generate +$X efficiency and unblock $Y pipeline that we currently lose in the dark.”

Cloud vs On-Premise CRM: honest pros/cons

Cloud CRM (SaaS):

– Pros: faster rollout, automatic updates, remote access, simpler integration with other SaaS tools.

– Cons: recurring subscription cost, data lives on vendor infra (legal/compliance conversation in some industries).

– Pros: full data control, sometimes required in heavily regulated or government-adjacent environments.

– Cons: you own maintenance, upgrades, uptime, security patching, infrastructure. Translation: you’re now also an IT company.

If you’re not legally required to run on-prem, in 2025 cloud wins for 95% of companies because speed-to-value beats theoretical control.

RevOps: how revenue actually scales

RevOps (Revenue Operations) is the function that treats Marketing + Sales + CS + Finance as one revenue machine instead of four silos.

RevOps owns:

- Process design

- Tech stack integration

- Data cleanliness

- Reporting

- Hand-offs (MQL → SQL → Opportunity → Customer → Renewal)

Why this matters: Without RevOps, leadership argues about “whose fault” a miss was. With RevOps, leadership sees the whole funnel as one system and fixes constraints in order. You stop optimizing locally (“more leads!”) and start optimizing globally (“we’re losing $4M annually in onboarding churn; fix *that* first”).

RevOps is not overhead. It’s the gearbox.

Customer Relationship & Retention

Post-sale:

The initial “Closed Won” is not the finish line. It’s the starting line of expansion revenue.

To drive repeat purchases / expansion:

Day 1 onboarding – Customer needs to see value *fast*. You’re not trying to show them everything. You’re trying to get them 1 visible win.

QBRs (Quarterly Business Reviews) that don’t suck – Not “feature tour.” Instead: “Here’s ROI achieved. Here’s missed opportunity. Here’s what teams like you solve next.”

Adoption alerts – If usage drops, don’t wait for renewal panic. Reach out now. Low usage in Month 2 is future churn in Month 11.

Customer Success vs Customer Support (and why churn depends on knowing the difference):

- Customer Support = reactive. “Something broke,” “How do I…,” “I can’t log in.” Focus: resolution speed and accuracy.

- Customer Success = proactive. “Are you actually getting the business outcome you bought us for?” Focus: adoption, ROI, expansion.

If you only fund Support and not Success, here’s what happens:

- Customers stay technically alive but politically dead. Nobody internally is championing you.

- Renewal becomes a fight with Procurement, not a no-brainer with your power users.

Put simply: Support keeps the lights on. Success keeps the contract alive.

Customer Advocacy: when your customer becomes your best marketing

Advocacy is when a happy customer actively sells *for you*:

- They take reference calls

- They speak at your webinar

- They post “we implemented X and cut onboarding time 40%.”

How to build advocacy:

1. Deliver real value (obvious, but non-negotiable).

2. Make them look smart publicly. Send them the narrative: “Can I quote you as the leader who reduced churn 18% in Q2 by standardizing onboarding?” You are giving them career capital.

3. Reward them privately. Early roadmap access. Executive briefings. Swag is cute, but status is sticky.

Advocacy beats paid ads because it comes with baked-in trust.

How CRM improves retention

Your CRM is not just for net-new. Used right, it’s a retention engine:

– It surfaces renewal dates and expansion triggers so you’re never “surprised” by churn.

– It centralizes all touchpoints, so when the CSM changes, knowledge doesn’t reset to zero.

– It lets you score health (usage, support tickets, stakeholder churn) and act before it’s too late.

Retention is math: reducing churn by even a few percentage points compounds revenue way more cheaply than acquiring net-new customers at higher CAC.

Final Takeaway

Sales today is an operating system. Build the system right, and revenue becomes repeatable instead of lucky.