In the world of business, invoices play a vital role. They’re like official requests for payment from your customers, providing proof of a sale. In this article, we’ll explain sales invoices and why they are important. We’ll also discuss how to create them effectively.

What is a Sales Invoice?

A sales invoice, often referred to as a bill, is a document that a seller gives to a customer. It contains information about the items sold, the terms of payment, and the due date for payment.

It is a legally binding document that serves as evidence of the goods or services provided, along with the amount owed.

Why Sales Invoices are important

Sales invoices are more than just pieces of paper. They’re crucial for maintaining an efficient accounting system. They help in keeping track of sales revenue, creating a record of customer transactions, and forming the basis for tax reporting.

Companies use invoices to calculate the total sales achieved during a specific accounting period, assisting them in determining their gross and net profit.

Crafting Effective Sales Invoices

Designing a professional-looking invoice that accurately represents your business requires attention to detail. Here are some practical tips to consider when creating your sales invoices:

- Clear Payment Terms: State your payment terms, the due date, accepted payment methods, and any late payment fees. This prevents misunderstandings with your customers.

- Unique Invoice Number: Assign an invoice number to each invoice. This aids in tracking and recording customer transactions efficiently.

- Itemized Details: List each product or service separately on the invoice. This helps avoid disputes or confusion.

- Accurate Contact Information: Provide your company’s contact details, including email, phone number, and address. This information is useful for customers who may have questions.

- Professional Templates: Use professional invoice templates. You can use your company logo and branding to keep a consistent look and feel.

Timely Payments

Creating a well-crafted sales invoice is only part of the equation. Ensuring that you receive payments on time is equally important. Here are some tips to help you ensure timely payment:

- Negotiate Payment Terms: Before starting work, agree on payment terms with your customer. Discuss details like the payment period and method.

- Issue Invoices Promptly: Timely invoicing keeps cash flow smooth and demonstrates your commitment to prompt payment.

- Follow Up on Unpaid Invoices: Politely follow up on unpaid invoices. Sometimes, invoices might have been overlooked or lost.

Invoicing Errors

Errors in invoices can lead to disruptions with customers and hinder cash flow. Even small mistakes can have significant consequences, from delayed payments to legal disputes.

Taking the time to create invoices accurately is essential. No business wants to face conflicts with customers due to invoicing errors.

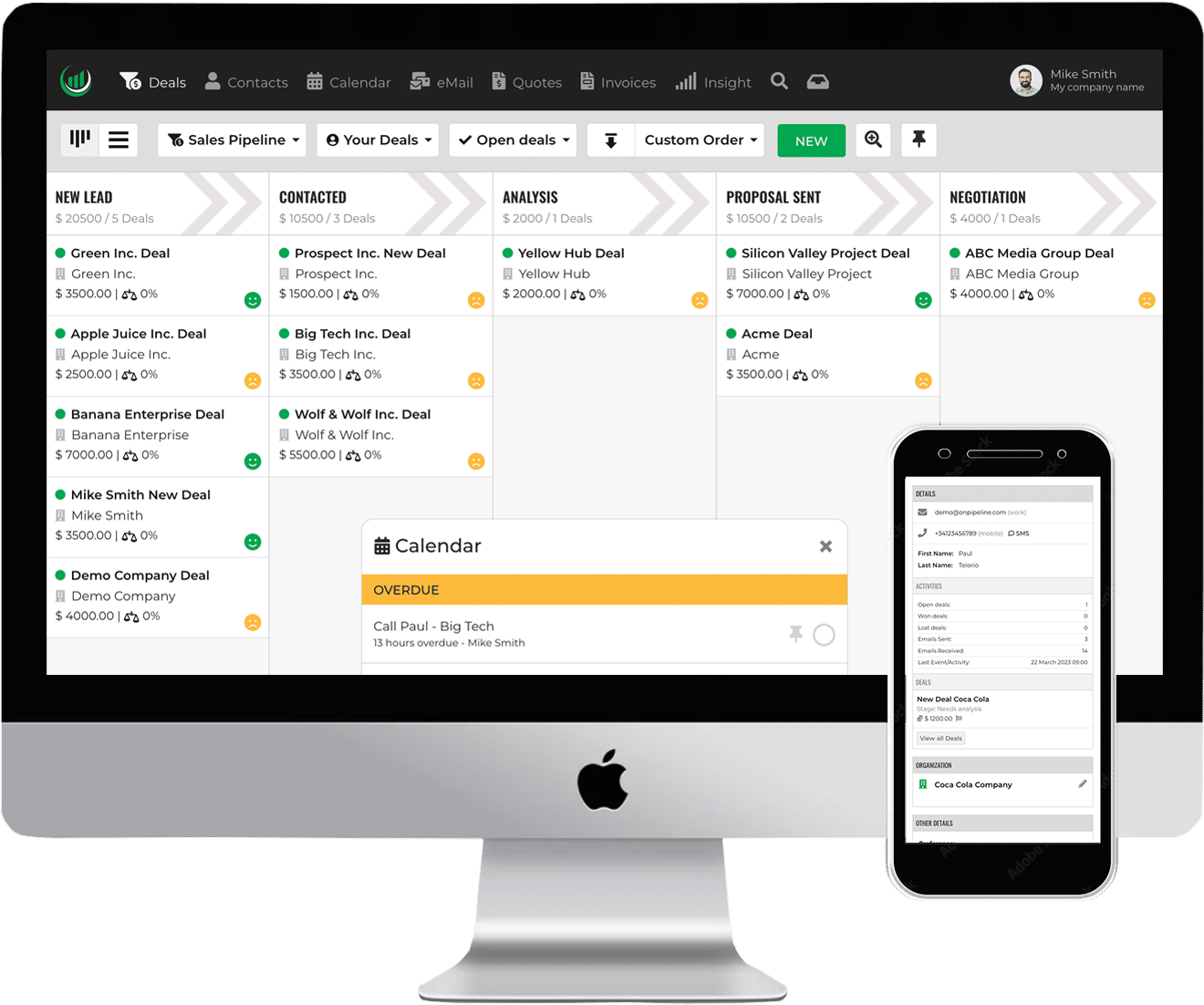

Invoicing & CRM Integration

Integrating invoicing software with a CRM (Customer Relationship Management) system offers multiple benefits for businesses. It simplifies the process of creating and sending invoices.

An integrated system allows you to generate and send invoices without manual data entry or switching between systems. This not only saves time but also enhances efficiency.

The Role of CRM in Invoicing

When integrated with a CRM, invoicing becomes even more streamlined and effective. Here’s how a CRM can assist:

- Provide sales teams with timely information about new invoices.

- Offer customer details promptly to the sales team.

- Notify the sales team about upcoming invoice due dates.

- Facilitate communication with customers regarding invoice status, payment deadlines, and related matters.

- Monitor orders and invoices to ensure accuracy.

- Generate reports on invoice activity for sales team review.

- Track payments made against issued invoices.

- Resolve customer disputes linked to billing or pricing discrepancies.

- Follow up with customers who have overdue accounts.

- Maintain comprehensive records of invoicing-related transactions.

The Backbone of Financial Management

Sales invoices are the backbone of effective cash flow management. They aid in tracking sales revenue, recording customer interactions, and complying with tax regulations.

Constructing an effective and professional-looking invoice involves including necessary information, outlining clear payment terms, and accurately calculating sales tax. By adhering to best practices and utilizing invoicing tools, you can ensure prompt payments, minimize disputes, and stay in line with tax requirements.

With these insights, you can establish an invoicing system that streamlines your financial operations, enhancing your business’s efficiency and success.

Frequently Asked Questions

In the transaction process, a sales invoice and a receipt are two separate documents.

They have different purposes.

A sales invoice is a document issued by the seller to the buyer before the payment is made. It acts as a formal request for payment and details the goods or services provided. The invoice has all the details: goods or services, quantities, price, total due, payment terms, and due date. The invoice is important for accounting purposes, as it records a sale and accounts receivable.

On the other hand, a receipt is issued after the payment has been made. It serves as proof of payment and confirms the completion of the transaction. Receipts usually have the payment date and amount, and may mention the invoice number for tracking.

Yes, sales invoices can be issued electronically. Digital invoices can be in different formats like PDFs sent by email. But e-invoices have specific standards for automated processing and integration with accounting systems.

Using electronic invoicing makes billing easier and cheaper by eliminating paper handling and mailing. It also facilitates quicker invoice delivery and payment processing, and improves record-keeping efficiency. Businesses must make sure their electronic invoicing follows the legal rules in their area.

Sales invoices are important records of transactions between sellers and buyers.

They are legally binding documents!

Sales invoices are important in legal disputes over payments or terms of sale. They can be used as evidence to resolve legal issues. They are also important for taxes because they show revenue and follow tax rules.

Businesses usually need to keep sales invoices from five to seven years to meet legal and tax rules in their countries.

This retention is crucial for tax filings, audits, and verifying financial records. The amount of time usually matches the time limit for tax and legal matters. With digital storage options, maintaining these records has become more manageable.

Businesses must follow their jurisdiction’s retention guidelines for financial management and legal compliance.