A CRM in financial services enhances processes and accelerates your sales pipeline. With a robust CRM software like Onpipeline, you can build trust-based customer relationships by equipping your team with timely, accurate information.

Insurance Agents – Financial Brokers – Tax Consultants – Financial Advisor – Credit Brokers

Benefits of CRM in Financial Services

Implementing a customer relationship management (CRM) system in the financial services industry can bring many advantages to companies. One of the key benefits is centralizing customer information and Know Your Customer (KYC) data. Here are some additional advantages of using a CRM system for KYC data:

Automated data collection

A CRM system can automatically collect customer information from various sources, including KYC documentation and other related documents, making it easier to store the data in one centralized place.

Improved accuracy

By collecting customer information and KYC documentation in one location with a CRM system, companies can reduce errors due to manual entry or inconsistent data formats across multiple channels.

Enhanced security

A CRM solution offers a secure, comprehensive platform that allows financial services providers to store sensitive customer and KYC data without any threat of security breaches or unauthorized access. This improves overall security measures and reduces compliance risks associated with storing confidential information across different systems.

Efficient document management

A CRM system enables financial services providers to manage their documents more efficiently since all documents are stored centrally and securely with easy retrieval capabilities using simple search filters or tags applied to each document type or category.

Streamlined communication

CRMs enable consistent, streamlined communication between customers and service providers by providing access to up-to-date records related to customers’ previous engagements with the company or account activities, as well as automated notifications for customers regarding upcoming payments or deadlines or any changes made to service plans accordingly. This helps ensure reliable communication between both parties throughout the course of their engagement, and better facilitates onboarding new accounts as well as retraining existing ones over time.

Overall, utilizing a CRM system for storing customer information and KYC data brings numerous advantages that help streamline internal operations while ensuring improved accuracy and enhanced security at the same time when dealing with sensitive client information. By leveraging these features, financial services companies have an opportunity to stay competitive in today’s market while also meeting regulatory requirements more easily when dealing with collected customer data over time

Capture key data

With a CRM for Financial Services you can grow revenues by building greater efficiency in every stage of the sales process and customer lifecycle.

A Finance CRM ensures that your employees are able to access customers data, learn their needs, and surprise them with quick solutions.

You may customise your CRM database for assets, data, commissions, etc. Morever, you can store your KYC documents directly in the client record.

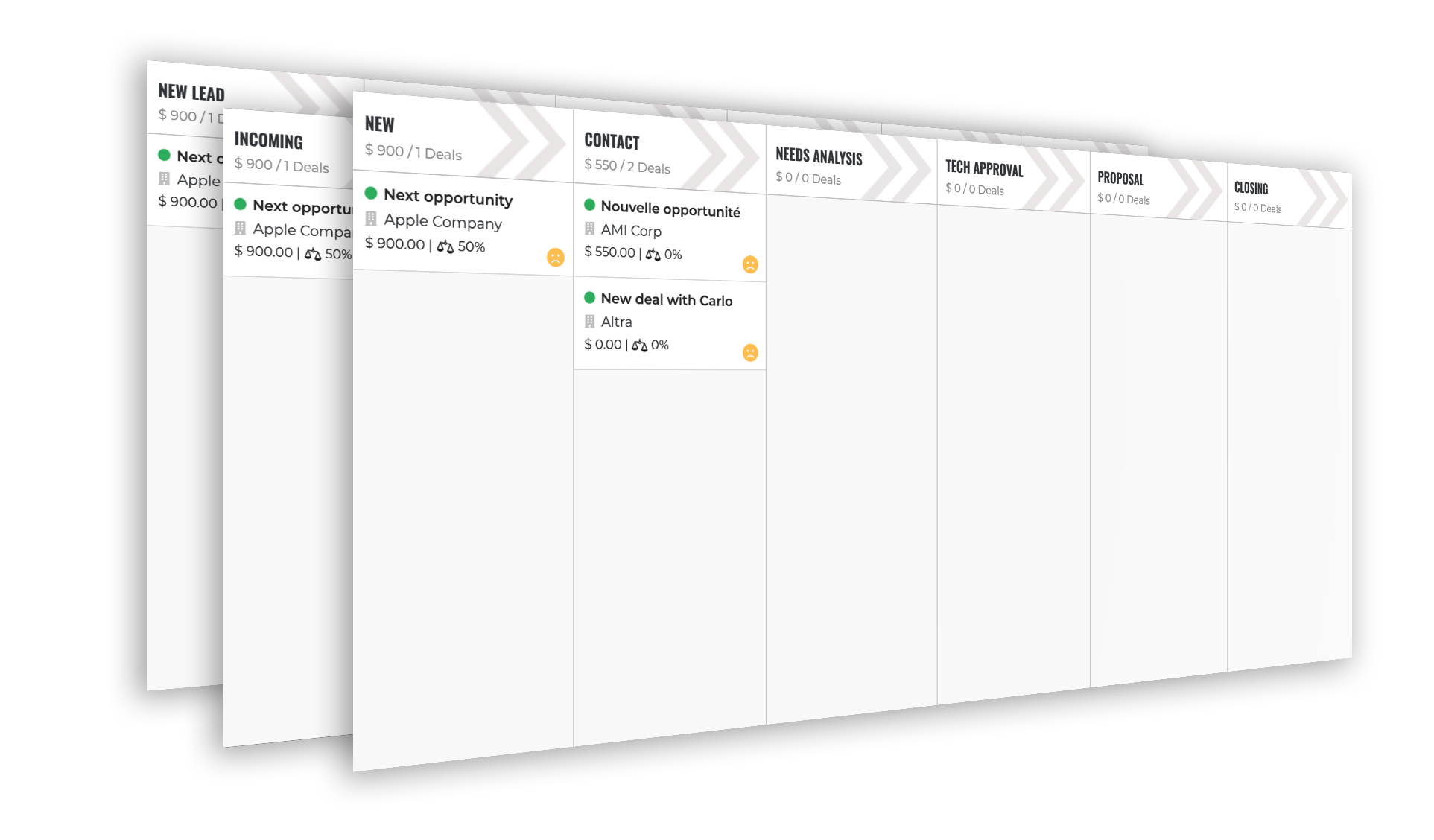

Sales Pipelines

A sales pipeline will help financial service companies visualize your sales process. In other words, it will show where your deals are!

A visual sales pipeline makes goals easier to achieve by breaking any process down into trackable tasks and it can make the difference in your bottom line.

Your sales teams have a complete view of your customers with a single sales and service solution, that integrates with your internal systems.

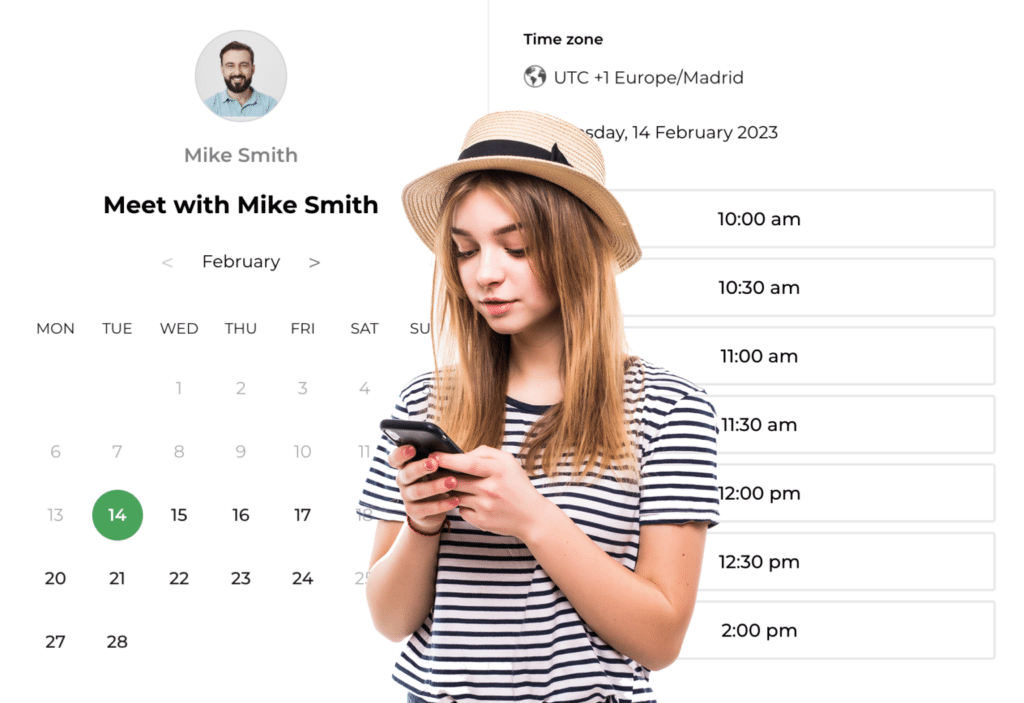

Appointment booking

Save time spent on making appointments over phone and emails with our online appointment booking software.

Financial services reps can establish their availability and allow patients to make appointments at any time of day or night by utilizing their online booking system.

Customers can receive an automated reminder via email or text message (SMS). You can also customize the reminders to include any information you would like, such as time, date, location, etc.

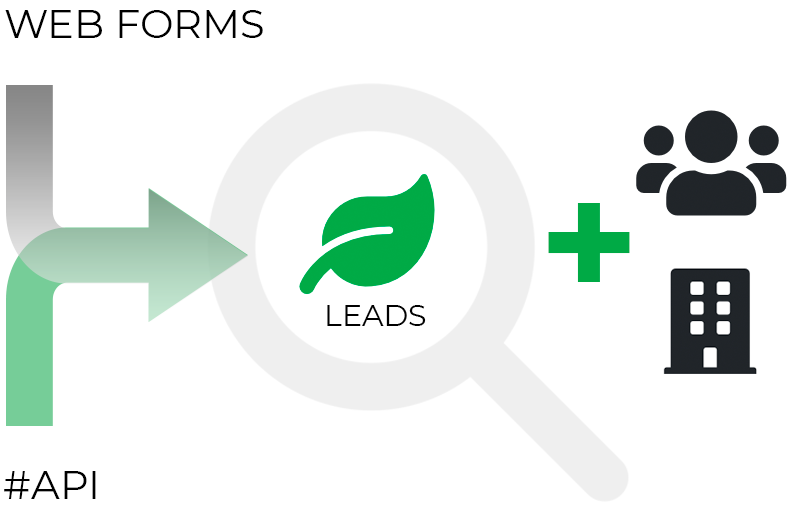

Save New Leads

Financial services can capture new leads directly from your website or 3rd parties (agents) into your CRM and automatically create tasks to follow up, send welcome emails, etc.

With Onpipeline you can receive new leads by integrating external systems. Furthermore, you can create unlimited Web Forms to collect new Leads (with referral management). You may use your company logo, colors and styling options to match your branding.

Your marketing team will be able to collect leads from a variety of popular forms, including WordPress Forms (WPForms), JotForm, Gravity Forms, Facebook Leads, and Google Leads.

Free for 30 days!

No contract and no credit card required. Fully operational account. You can try and confirm the same settings by placing an order, or simply let the trial period expire.

Get startedOnpipeline™ is a Sales CRM Platform designed to manage customers and sales from anywhere.

Should you have any questions about features, pricing or anything else, please contact us

© Onpipeline Ltd

Never send passwords in plain text!

Protect them for free with Secret Once

Onpipeline

Never send passwords in plain text!

Protect them with Secret Once