Businesses are concerned about how their churn rate affects revenue and profitability. They want to reduce churn because it’s more cost-effective and beneficial than finding new customers. Reducing churn rate is like strengthening customer retention. Both ideas focus on keeping and growing valuable customer relationships.

What is Customer Churn?

Customer churn, or customer attrition, is a way to measure how many customers leave a company. Churn can occur in various industries, including telecommunications, subscription services, e-commerce, and more. Keeping existing customers is usually more profitable and cost-effective than getting new ones.

Let’s say a company begins a month with 1,000 customers. During the month, they gain 200 new customers but they lose 100 customers. In this case, the churn rate for the month is 10%.

Achieving a churn rate of exactly 0% is impossible in practice for most businesses. Customer turnover is inevitable because of factors that companies can’t control.

But companies should try hard to reduce churn as much as they can. They should aim for the lowest rate possible in their industry and market.

Churn can take different forms, such as:

Voluntary Churn

This happens when customers choose to stop using a company’s products or services. Customers may leave for different reasons. They might be unhappy, find a better option, or no longer need the product.

Involuntary Churn

Sometimes, customers have to leave due to things beyond their control, such as expired credit cards or technical problems.

Reactive Churn

It happens when customers leave because of a problem with the product or service. They may leave because of a negative experience.

Proactive Churn

It is when a company finds customers who might leave and stops them from leaving. This can involve providing special offers, incentives, or proactive customer support.

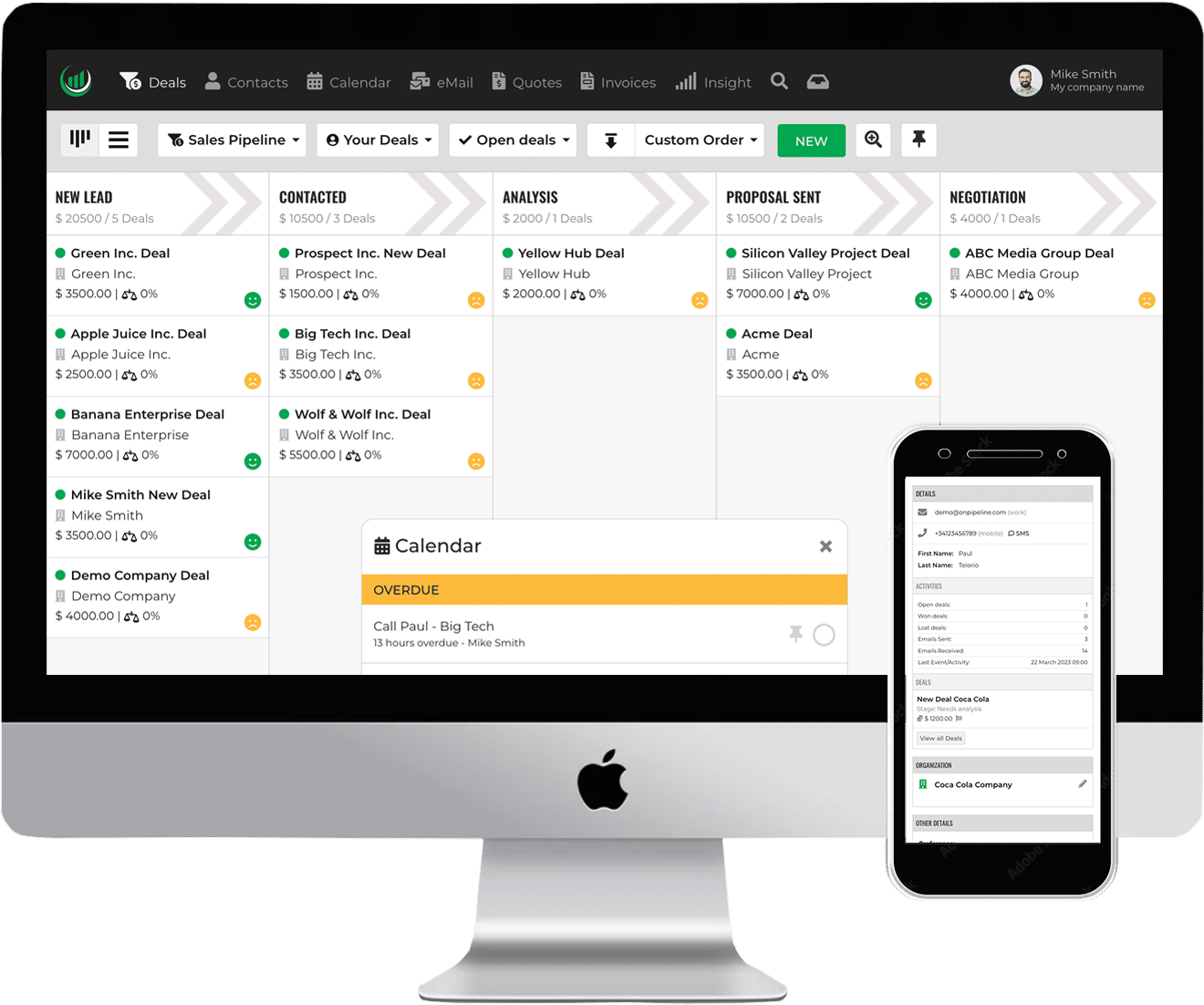

Get Started for FreeWhy Churn Rate is Important?

It is important for different reasons. Its significance changes based on the business and industry. Here are some key reasons why churn rate is important:

Revenue Impact

Churn affects a company’s revenue. When customers or subscribers leave, they no longer generate income for the business. High churn rates can lead to a significant loss of revenue over time.

Customer Lifetime Value

The concept of customer lifetime value (CLV) ties to churn rate. To calculate CLV, it is helpful to know how long customers stay with the company and how much revenue they generate. Companies with lower churn rates tend to have higher CLV.

Cost of Customer Acquisition

Acquiring new customers can be expensive, involving marketing, advertising, and sales efforts. When a company has high churn rates, it must get more new customers to keep its customer base. This can be expensive.

Brand Reputation and Customer Satisfaction

High rates often indicate customer dissatisfaction. A company’s reputation can suffer if customers are leaving due to poor experiences. Satisfied, long-term customers can also become advocates for the brand.

Operational Efficiency

It can result in operational inefficiencies. Onboarding new customers to replace departing ones can strain resources. Reducing churn allows a company to allocate resources more efficiently.

Competitive Advantage

Companies with lower churn rates have a competitive advantage. Instead of always trying to get new customers, they can focus on keeping and pleasing the ones they already have. This can lead to a more stable and profitable business model.

Data-Driven Decision-Making

Churn can provide insights into customer behavior and preferences. A company can improve by analyzing why customers are leaving and using data to make decisions.

Risk Assessment

You can use it to assess the risk associated with a company’s customer base. A high rate puts the company at risk from market changes, economic downturns, or competition.

Investor and Stakeholder

Investors and stakeholders watch churn rates to gauge a company’s health and growth potential. Lower churn rates can increase confidence in the company’s future prospects.

Retention Strategies

The data on churn rate tells us which customers are most likely to leave. This information is valuable for developing targeted retention strategies and improving customer engagement.

Get Started for FreeHow to reduce Churn

To achieve this, a multi-faceted approach is essential.

- Make sure to provide excellent customer support using different methods, so that you can address any customer concerns.

- Improving your product or service and listening to customers are important actions to take.

- Put in place loyalty programs, discounts, and incentives. Engage with customers by offering personalized solutions and check-ins.

- Use data analytics to predict churn risks and take preventive measures.

- Keep a close eye on competitors and reassess your value proposition.

- Segment your customer base to offer tailored communication and incentives.

Reactivation Campaigns

To win back customers who left, use a reactivation campaign. Teach customers about your product’s advantages. Give flexible subscription choices. Watch customer health to find at-risk customers. Evaluate how well these strategies work and stay in touch with customers to adjust and get better.

SHARE THIS ARTICLE